WoodGreen operates year-round tax clinics for low-income individuals and households. The tax clinic assists with the preparation of simple tax returns, up to 10 years of back taxes and T1 adjustments. We also support with Notices of Assessment and responses to Canada Revenue Agency letters. Volunteers Vidya Sadama and Kelly Cole explain why WoodGreen is the ideal place to get help with your taxes.

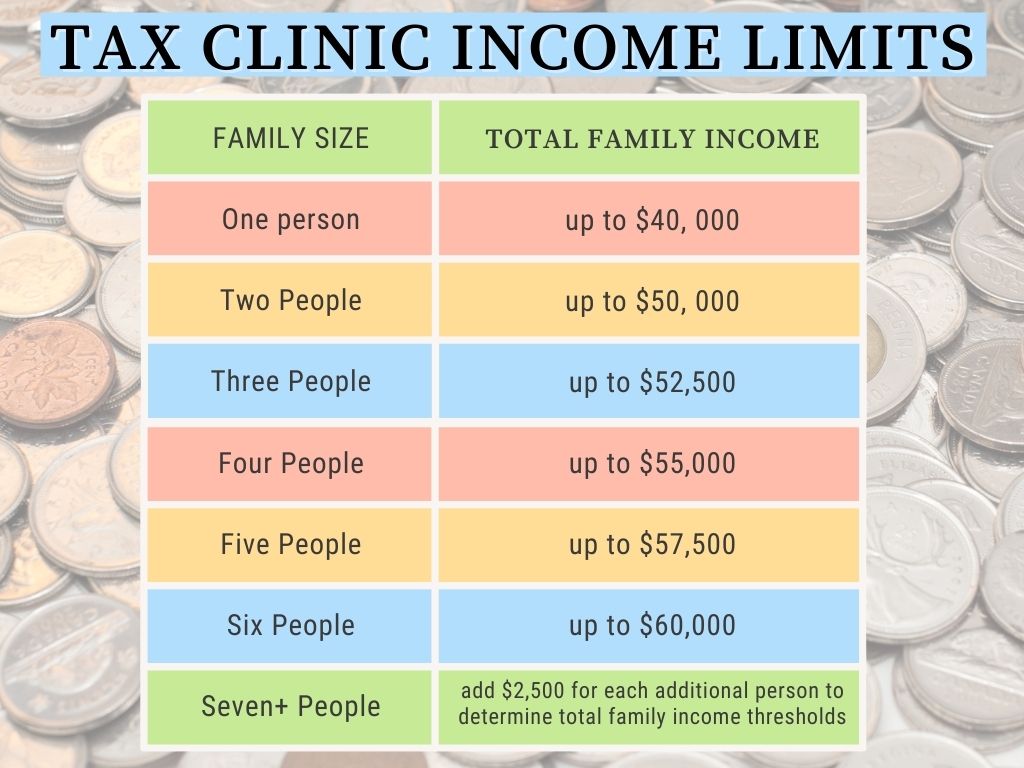

1. It’s FREE for those who qualify

The community volunteer income tax program is designed for low-income earners, students, seniors and newcomers to Canada. We complete and file your tax returns for FREE! These are the income limits for using our FREE service.

2. Straightforward returns are easy for us

There are a few people we can't do tax returns for. Tax returns that we CANNOT complete include:

- Earning above the designated low-income limit

- Self-employed

- Has rental income

- Earned certain types of investment income

- Filing for bankruptcy this year

- Filing for a deceased person

*Volunteers may make exceptions if someone exceeds the income threshold but still needs support to complete the tax return or if that person is currently unemployed or experiencing a severe decrease in income.

3. We're pretty popular

We help a wide range of people from all walks of life. Many are low-income individuals on Ontario Disability Support Program (ODSP) or Ontario Works (OW). Some are students, while others are retired, unemployed or employed or newcomers to Canada. The clinic also helps people who haven’t completed their taxes in past years (back to 2012). Back taxes are completed after peak tax season which ends April 30.

4. We reduce stress

For many people taxes can equal stress. But it doesn’t have to be that way. We find that many clients simply need their returns completed and filed in order to ensure other benefits are renewed.

5. We know what we’re doing

If you’re feeling overwhelmed by filing taxes, we can help.

We’ll complete your return, answer any questions you may have, help you understand your return and what benefits might be available to you. We know the proper way to do simple income tax returns. If there are issues after taxes are filed, we are able to follow up.

6. We find savings that people often miss

Why leave money lying on the table? We make sure you've filed for all eligible deductions such as:

- Senior’s transit allowance

- Disability tax credit

- Claiming rent or property tax

- Tuition fees tax credit

- Donations tax credit

- Medical receipts credit

If clients are missing tax slips we can help them download them from Canada Revenue Agency.

7. We are ready to start when you are

All you need to do is gather your tax slips (here's how to do that), and rent/property tax receipts. It’s helpful to also have last year’s return. We'll need direct deposit banking information, donation or medical receipts as well as any tuition tax slips.

8. We know all the tax benefits available

Our tax volunteers will correctly file your return to claim all of the refunds and benefits for which you are eligible and can answer all your questions so it all makes sense to you.

9. We really love doing taxes. No, really!

"It's a great way to give back to the community and for me personally to learn and develop my skills in tax, communication, and leadership.”

-- Vidya Sudama, Tax Volunteer Lead“I like doing taxes and I like to help people. This is a win-win for me. I have been involved in the CVITP program for over 15 years and I find it's very rewarding to me and to my clients. I'm a Volunteer Tax Lead at WoodGreen (I manage tax preparers on a virtual shift) and I always tell my preparers that we are saving the world, one tax return at a time.”

-- Kelly Cole, Volunteer Tax Lead

10. We’re open all year

During tax season (March & April) we're open:

- Tuesdays, Wednesdays and Thursdays 1:30 p.m.-4:30 p.m. and 5:30 p.m.-8:30 p.m.

- Saturdays 10 a.m. to 1 p.m.

After tax season, we're open once a week. Please visit our website for more details.

Your last day to file taxes for this year is April 30, 2022.